Irs tax calculator 2020

Nearly 16 million taxpayers will automatically receive more than 12 billion in refunds or credits. Estimate your federal income tax withholding.

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Enter your filing status income deductions and credits and we will estimate your total taxes.

. Your 2020 tax rate. What is your tax bracket. The purpose of this calculator to give you an idea about your tax liability so that you.

The Internal Revenue Service IRS is responsible for publishing the latest Tax Tables each year rates are typically published in 4 th quarter of the year proceeding. Based on your projected tax withholding for. If you owe you have more time to gather the money.

Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax calculator. 1040 Tax Estimation Calculator for 2020 Taxes.

Use this 1040 Income Tax Calculator to estimate your tax bill or refund. The IRS is also refunding many penalties if you already paid. How It Works.

Our sole and only guarantee or warranty is that anyone who influences us to change our algorithm by more than ten cents 010 will. Our W-4 Calculator can help you determine how to update your W-4 to get your desired tax. See how your refund take-home pay or tax due are affected by withholding amount.

Please pick two dates enter an amount owed to the IRS and click Calculate. Effective tax rate 172. Estimate your state and local sales tax deduction.

Use your income filing status deductions credits to accurately estimate the taxes. Prior Year FederalState Tax Prep. Figures based on the Federal IRS.

0 - 9875 9876 - 40125 40126 - 85525 85526 - 163300 163301 - 207350 207351 - 518400 518401. To lower the amount you owe the simplest way is to adjust your tax withholdings on your W-4. Our IRS Penalty Interest calculator is 100 accurate.

The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return. Enter your filing status income deductions and credits and we will estimate your total taxes. File Now Get Your 2020 IRS Tax Refund Fast.

Ad Always Free Always Simple Always Right. You can use the Tax Withholding Estimator to estimate your 2020 income tax. Based on your projected tax withholding for the.

2020 Federal Tax Tables. Use the PriorTax 2020 tax calculator to find out your IRS tax refund or tax due amount. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes.

Figure out the amount of taxes you owe or your refund using our 2020 Tax Calculator. And is based on the tax brackets of 2021 and. For more information see IRS Publication 501.

For help with your withholding you may use the Tax Withholding Estimator. Our free tax calculator is a great way to learn about your tax situation and plan ahead. IRS tax forms.

This calculator computes federal income taxes state income taxes social security taxes medicare taxes self-employment tax capital gains tax and the net investment tax. US tax calculator is a web calculator for quickly finding the tax on your total income. If the return is not complete by 531 a 99 fee for federal and 45 per state return.

Prepare File Prior Year Taxes to the IRS Fast. Enter your filing status income deductions and credits into the income tax calculator below and we will estimate your total taxes for 2016. Enter your filing status income deductions and credits and we will estimate your total taxes for tax year 2020.

Sales Tax Deduction Calculator. 2020 Simple Federal Tax Calculator. Use this tool to.

It is mainly intended for residents of the US. Based on your projected tax withholding for the year we can also estimate. Earned income tax credit calculator.

The calculator listed here are for Tax Year 2020 Tax Returns. Include your income deductions and credits to calculate. If you get a refund you can plan how you will use the.

Tax Withholding For Pensions And Social Security Sensible Money

Inkwiry Federal Income Tax Brackets

Inkwiry Federal Income Tax Brackets

Excel Formula Income Tax Bracket Calculation Exceljet

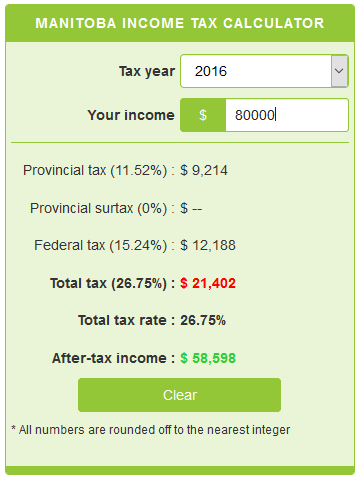

Manitoba Income Tax Calculator Calculatorscanada Ca

How To Calculate Federal Income Tax

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

How To Calculate 2021 Federal Income Withhold Manually With New 2020 W4 Form

Federal Income Tax Calculator Find Your Irs Refund Payment For Your Return

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

How To Calculate Payroll Taxes For Your Small Business

Income Tax Calculator Calculatorscanada Ca

Complete Guide To Canadian Marginal Tax Rates In 2020 Kalfa Law

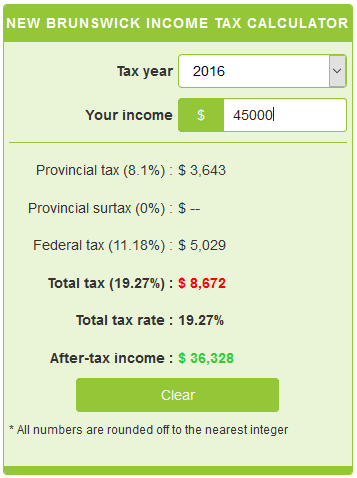

New Brunswick Income Tax Calculator Calculatorscanada Ca

How To Calculate Federal Withholding Tax Youtube

What Are Marriage Penalties And Bonuses Tax Policy Center

Tax Calculator Estimate Your Income Tax For 2022 Free